Anda mahukan trading kurang risiko tanpa pening kepala membuat analisa yang 99% MUSTAHIL TEPAT?

Cubalah HEDGING!Anda mesti pernah dengar hedging. Hedging adalah bermaksud membuka dua posisi buy dan sell serentak. Tujuan hedging adalah sebagai insuran untuk melindungi equiti dari kerugian akibat salah buka posisi trading. Namun,

tahukah anda bahawa anda sebenarnya bukan sahaja boleh lindungi equity

dari kerugian, tapi anda juga boleh menghasilkan profit dengan syarat

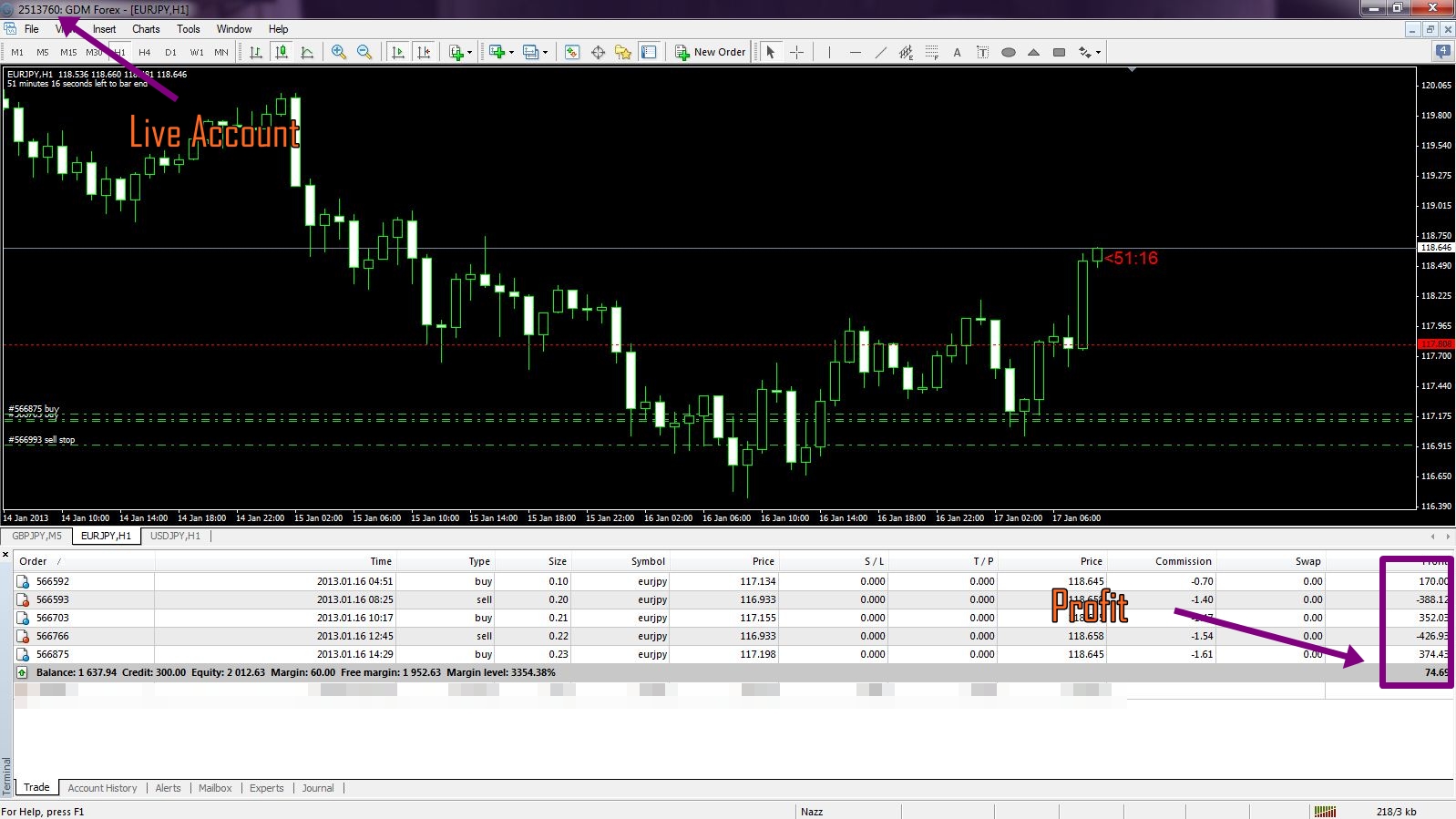

anda menggunakan cara yang betul! Nak lihat bagaimana strategi hedging yang hebat ini menghasilkan profit? Ayuh lihat paparan trading berikut:

Nampak mudah bukan?

Namun jika anda tidak punyai strategi yang betul dalam hedging, anda

tetap terdedah degan risiko kerugian. bahkan lebih teruk lagi akaun

anda boleh margin call. Dapatkan salinan ebook hedging dengan setiap pembelian ebook Teknik Pullback hari ini juga!Ayuh! TINDAKAN SEGERA! Tempahlah sekarang.

Ayuh dapatkan ebook ini segera sebelum kuota penuh!

Tindakan segera dengan membuat tempahan sekarang juga.Dapatkan $5 USD percuma untuk pendaftaran akaun live baru!

Kepuasan anda adalah dijamin 100% 2013. Hakcipta terpelihara.

Disclaimer. Please read.

CFTC Rule 4.41

Hypothetical or simulated performance results have certain

limitations. Unlike an actual performance record, simulated results do

not represent actual trading. Also, since the trades have not been

executed, the results may have under-or-over compensated for the impact,

if any, of certain market factors, such as lack of liquidity. Simulated

trading programs in general are also subject to the fact that they are

designed with the benefit of hindsight. No representation is being made

that any account will or is likely to achieve profit or losses similar

to those shown. No representation is being made that any account will,

or is likely to achieve profits or losses similar to those discussed

within this site, support and texts. Our course(s), products and

services should be used as learning aids only and should not be used to

invest real money. If you decide to invest real money, all trading

decisions should be your own.

Hypothetical performance results have many inherent limitations,

some of which are described below. No representation is being made that

any account will or is likely to achieve profits or losses similar to

those shown. In fact, there are frequently sharp differences between

hypothetical performance results and the actual results subsequently

achieved by any particular trading program. One of the limitations of

hypothetical performance results is that they are generally prepared

with the benefit of hindsight. In addition, hypothetical trading does

not involve financial risk, and no hypothetical trading record can

completely account for the impact of financial risk in actual trading.

For example, the ability to withstand losses or adhere to a particular

trading program in spite of trading losses are material points which can

also adversely affect actual trading results. There are numerous other

factors related to the markets in general or to the implementation of

any specific trading program which cannot be fully accounted for in the

preparation of hypothetical performance results and all of which can

adversely affect actual trading results.

|

|