The Patient Trader: Lessons from the Legendary Jesse Livermore

In the annals of stock market history, few names evoke as much awe and fascination as Jesse Livermore. Known as the “Boy Plunger” and the “Great Bear of Wall Street,” Livermore’s life was a testament to the highs and lows of trading, punctuated by remarkable successes and sobering failures. Yet, amidst the volatility of the markets, one enduring lesson stands out: the importance of patience.

Livermore’s journey into the world of finance began humbly in the early 20th century. As a teenager, he worked as a chalk boy in a Boston brokerage firm, where he absorbed the ebbs and flows of the market like a sponge. Through keen observation and relentless study, he honed his instincts and developed a deep understanding of market dynamics.

“In the Panic of 1907, Livermore’s huge short positions made him $1 million in a single day. However, his mentor, J. P. Morgan, who had bailed out the entire New York Stock Exchange during the crash, requested him to refrain from further short selling. Livermore agreed and instead, profited from the rebound, boosting his net worth to $3 million.”

Source: Wikipedia

His rise to prominence was not without its obstacles. Livermore faced numerous setbacks and bankruptcies along the way, but each failure served as a valuable lesson in the school of hard knocks. Through sheer grit and determination, he persevered, undeterred by the challenges that lay ahead.

One of Livermore’s most legendary trades occurred during the Panic of 1907. Sensing an impending market crash, he made a bold decision to short the market, a move that defied conventional wisdom at the time. His foresight proved to be uncanny, as the market indeed plunged into chaos, leaving many investors in ruin. Livermore emerged from the turmoil not only unscathed but significantly wealthier, solidifying his reputation as a master of the markets.

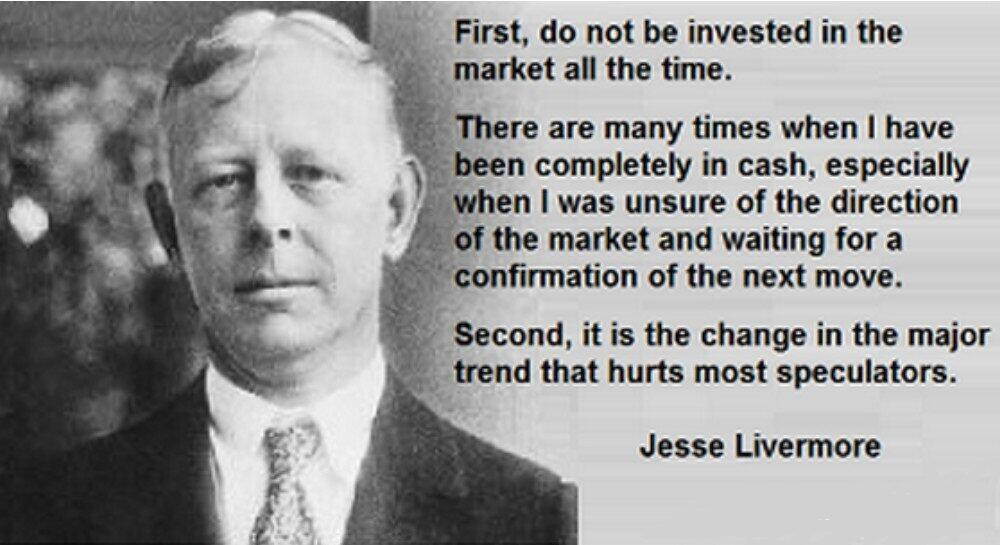

However, Livermore’s success was not merely a result of his ability to predict market movements; it was also a testament to his patience and discipline. He understood that the key to successful trading lay not in frantic buying and selling, but in the art of waiting. “The big money,” he famously quipped, “is not in the buying and selling, but in the waiting.”

Livermore’s philosophy of patience was rooted in a deep respect for the ebb and flow of market cycles. He recognized that true opportunities were rare and fleeting and that the impulsive pursuit of quick profits often led to ruin. Instead, he advocated for a methodical approach, characterized by careful analysis, strategic planning, and unwavering discipline.

Despite his legendary successes, Livermore was not immune to the pitfalls of impatience and emotional trading. At times, he deviated from his own principles, succumbing to the temptations of greed and fear. These lapses in judgment resulted in significant losses, serving as painful reminders of the importance of discipline and self-control.

Livermore’s life serves as a powerful reminder of the timeless virtues of patience and discipline in trading. His story is a testament to the enduring power of resilience and perseverance in the face of adversity. By embracing the lessons of Jesse Livermore, traders can cultivate the patience and fortitude needed to navigate the unpredictable waters of the market successfully.

In conclusion, Jesse Livermore’s legacy as a patient and disciplined trader continues to inspire generations of investors to this day. His story serves as a timeless reminder that in the fast-paced world of finance, patience is not just a virtue—it’s a necessity.

Image source: Internet