Understanding Break of Structure (BoS) in Trading

In the realm of technical analysis, the Break of Structure (BoS) is a pivotal concept for traders. It signifies a crucial point where the market confirms a trend continuation or reversal by breaking through established support or resistance levels. Understanding and identifying BoS can enhance trading strategies and improve decision-making.

What is Break of Structure?

A Break of Structure occurs when the price action of an asset breaks through a significant level of support or resistance. This break indicates a shift in market dynamics, signaling either the continuation of the current trend or a potential reversal. BoS is a critical element in price action trading, offering traders clear signals for entering or exiting positions.

Identifying Break of Structure

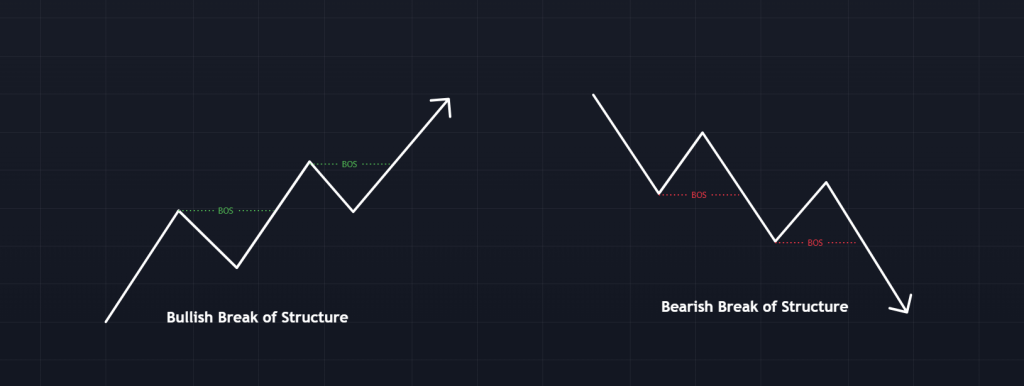

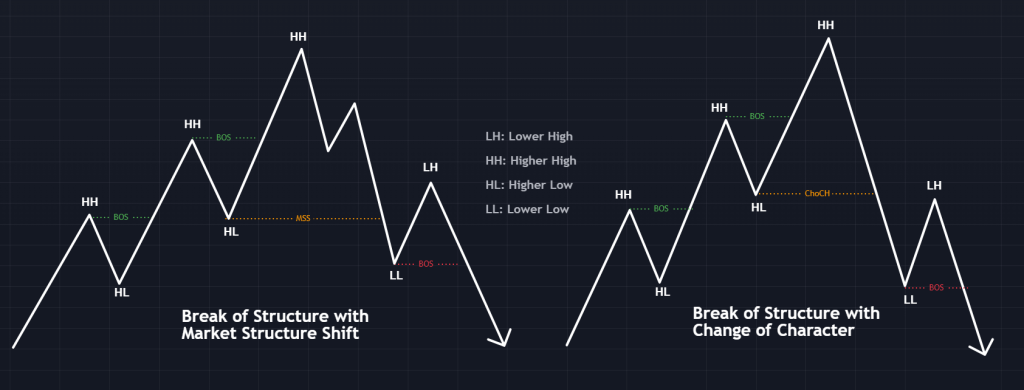

1. Trend Continuation: In a bullish trend, a BoS is confirmed when the price breaks above the previous high, signaling that the uptrend is likely to continue. Conversely, in a bearish trend, a BoS is confirmed when the price breaks below the previous low, indicating the downtrend is set to persist.

2. Trend Reversal: A BoS indicating a reversal happens when the price breaks a key level that signifies the end of the current trend and the beginning of a new one. For example, in a bullish trend, a break below a significant support level can signal a potential reversal to a bearish trend.

Example of Break of Structure

Consider a bullish trend where the price has been making higher highs and higher lows. A BoS would be identified when the price breaks above a recent high, confirming that the bullish trend is continuing. If the price breaks below a recent low instead, this may signal a potential reversal to a bearish trend.

Why is BoS Important?

1. Entry and Exit Signals: BoS provides traders with clear entry and exit points. For instance, a trader might enter a long position upon a bullish BoS or exit a position upon a bearish BoS.

2. Risk Management: By identifying BoS, traders can better manage risk by adjusting their positions accordingly. For example, they might set stop-loss orders at levels just below the BoS to protect against unfavorable movements.

3. Market Sentiment: BoS reflects a change in market sentiment, offering insights into the underlying strength or weakness of a trend. This information can be critical for making informed trading decisions.

Combining BoS with Other Indicators

For enhanced accuracy, traders often combine BoS with other technical indicators, such as moving averages, volume, or support and resistance levels. This combination provides stronger confirmation and helps in filtering out false signals.

Conclusion

The Break of Structure (BoS) is a fundamental concept in technical analysis that helps traders identify key market movements and make informed trading decisions. By understanding and applying BoS, traders can enhance their strategies, improve risk management, and gain a deeper insight into market dynamics. Whether you are a novice or an experienced trader, mastering the concept of BoS is essential for navigating the financial markets successfully.

ADMIN

16/07/24

Credit: tradingview, howtotrade