WHY TIGHT SPREAD MATTERS | VANTAGEFX REVIEW

In forex trading, the tightness of the spread refers to the difference between the bid price (the price at which you can sell a currency pair) and the ask price (the price at which you can buy a currency pair). A tight spread means that this difference is small, while a wide spread means the difference is larger. Tight spreads are generally preferred by forex traders for several reasons:

- Lower Transaction Costs: Tight spreads mean lower transaction costs for traders. When the spread is narrow, traders pay less in fees every time they enter or exit a trade. This is particularly important for frequent traders or those trading large volumes, as transaction costs can significantly eat into profits.

- Better Entry and Exit Points: Tight spreads allow traders to enter and exit positions more easily and at more favorable prices. With a tight spread, traders are more likely to get their orders filled closer to the prices they want, reducing the slippage between the quoted price and the execution price.

- Improved Profit Potential: Narrow spreads mean that traders start their positions closer to breakeven, which improves the potential for profit. When spreads are wide, traders need the market to move more in their favor before they can start making a profit. Tight spreads mean that traders require smaller price movements to make a profit, making trading more efficient.

- Enhanced Liquidity: Forex markets with tight spreads tend to have higher liquidity. Liquidity refers to the ease with which traders can buy or sell a currency pair without causing significant price movements. Higher liquidity means there are more buyers and sellers in the market, reducing the likelihood of price spikes or gaps and providing traders with more stable pricing.

- Reduced Risk: Tight spreads can help reduce the risk associated with trading. When spreads are wide, it can be more challenging to accurately predict when a trade will become profitable due to the larger gap between buy and sell prices. Tight spreads provide traders with more transparency and predictability in pricing, which can help mitigate risk.

Overall, tight spreads are important in forex trading because they contribute to lower transaction costs, better entry and exit points, improved profit potential, enhanced liquidity, and reduced risk, all of which are crucial factors for successful trading.

WHAT ARE SPREADS?

In financial markets, including forex trading, a spread refers to the difference between the bid price and the ask price of a security or asset. Here’s what each term means:

- Bid Price: This is the price at which a trader can sell a particular currency pair. In other words, it’s the highest price that a buyer is willing to pay for the currency pair at any given moment.

- Ask Price: Also known as the offer price, this is the price at which a trader can buy a particular currency pair. It’s the lowest price at which a seller is willing to sell the currency pair.

The spread is calculated by subtracting the bid price from the ask price. Mathematically, it’s expressed as:

Spread = Ask Price – Bid Price

For example, if the bid price for EUR/USD is 1.2000 and the ask price is 1.2002, the spread would be:

Spread = 1.2002 – 1.2000 = 0.0002 or 2 pips

The spread is typically measured in pips, which stands for “percentage in point” or “price interest point” and is the smallest price move that a given exchange rate can make based on market convention.

In forex trading, spreads can vary depending on factors such as liquidity, market volatility, and the broker’s pricing model. Tight spreads refer to a small difference between the bid and ask prices, while wide spreads indicate a larger difference. Traders generally prefer tight spreads because they reduce trading costs and provide better opportunities for profit.

HOW ARE SPREADS CALCULATED?

Spread is usually expressed as a percentage, and can be calculated using the formula below:

Spread % = [(Ask Price – Bid Price) / Ask Price] x 100

Where:

Ask Price – Refers to the lowest price that a currency dealer is willing to sell units of the currency for

Bid Price – Refers to the highest price that a currency trader is willing to buy units of the currency for

LOW, INDUSTRY-LEADING FOREX SPREADS

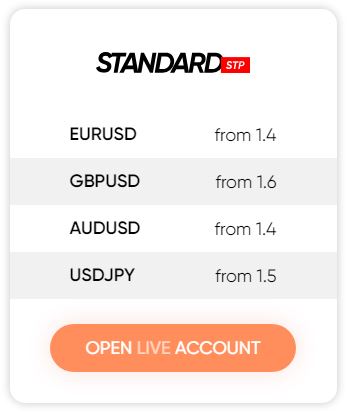

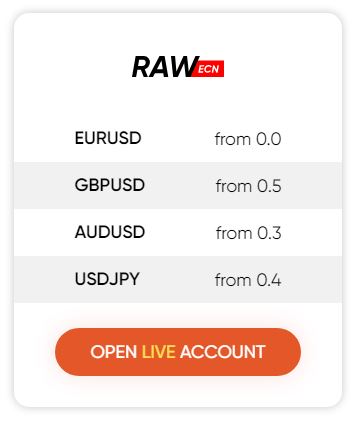

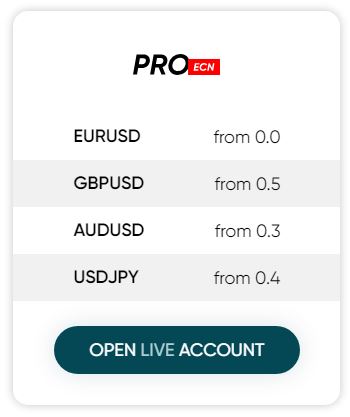

Leveraging fees from a network of banks and liquidity providers, Vantage is able to offer our clients ultra-competitive spreads starting at 0.0 pip for RAW ECN accounts, and 1.0 pip for Standard STP accounts. For major forex currencies, you can enjoy spreads under 1 pip during high-liquidity periods.

P/S: Click one of the banner above for more details and open accounts.