What is a Clean Breakout in Candlestick Price Action? A Complete Guide for Traders

When it comes to trading price action, one of the most powerful and profitable setups is the clean breakout in candlestick patterns. Whether you’re trading forex, stocks, or crypto, mastering the art of identifying clean breakouts can give you a significant edge in the market. In this article, we’ll break down what a clean breakout is, how to spot it, and why it’s crucial for any price action trader.

What is a Clean Breakout in Candlestick Price Action?

A clean breakout occurs when price moves decisively beyond a key level of support or resistance with a strong candlestick close. This type of breakout signals momentum and strength from either buyers or sellers, making it an ideal opportunity for breakout traders.

Key Characteristics of a Clean Breakout

To differentiate a clean breakout from a false or messy one, look for the following signs:

1. Strong Candlestick Close Beyond Key Levels

The breakout candle should close fully above resistance (for bullish breakout) or below support (for bearish breakout). The body should be large, indicating strong momentum.

2. Minimal or No Wick on the Breakout Side

A candle with little to no wick on the breakout side shows that the price wasn’t rejected at that level, which is a strong confirmation.

3. Consolidation Before Breakout

Clean breakouts often follow a period of tight consolidation. This shows accumulation or indecision before price decides a direction.

4. Volume Spike (Optional but Helpful)

Although volume is more commonly tracked in stocks or futures, a surge in volume during the breakout adds extra confirmation to the move.

Avoiding False Breakouts

False breakouts can trap many traders, especially those who enter too early. To avoid this:

- Wait for the candle to close beyond the breakout level.

- Use higher timeframes like H1 or H4 for more reliable signals.

- Combine breakout analysis with candlestick confirmation like bullish engulfing or pin bar rejection (in case of retest).

Examples of Clean Breakout Setups

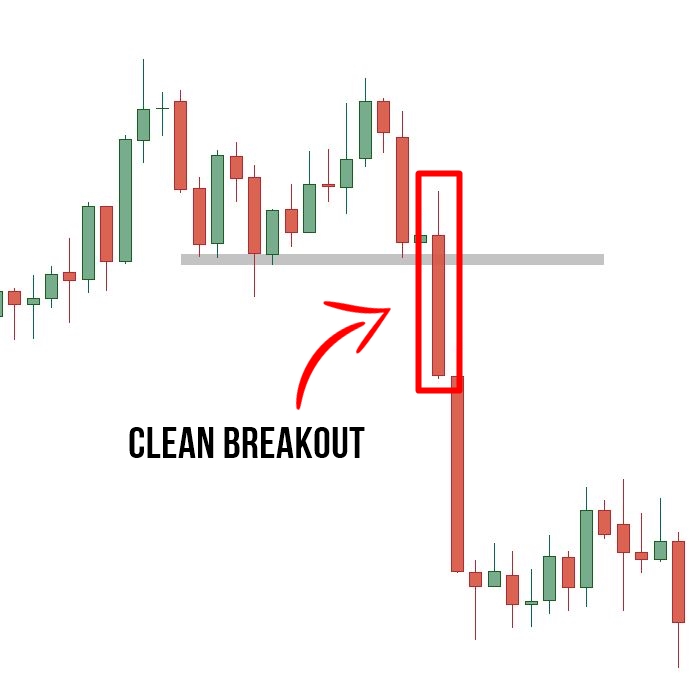

Clean Breakout example:

- Price forms a support or resistance zone.

- After multiple rejections, a large bullish candle closes clearly above/below the zone.

- No upper wick or very minimal wick.

- Followed by further bullish or bearish continuation.

- No sideways/noise after breakout

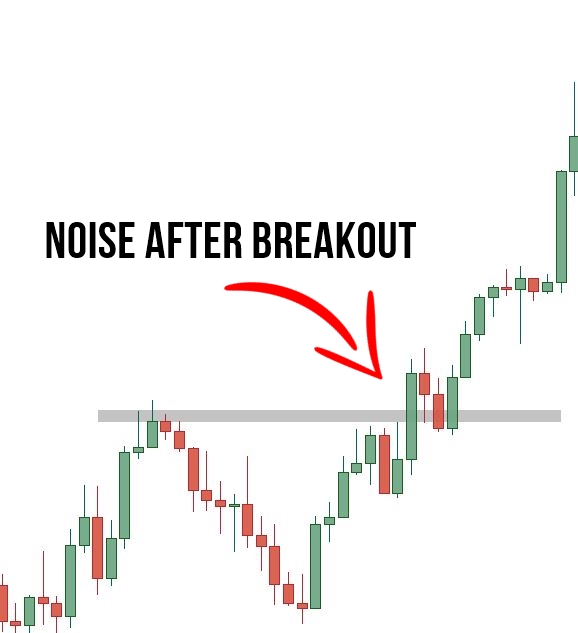

Noise Breakout:

- Price consolidates after breakout.

- Wick perform

Why Clean Breakouts Matter in Price Action Trading

Many traders lose money by chasing breakouts that lack confirmation. A clean breakout gives you:

- Higher probability trades.

- Better risk-to-reward ratio.

- Fewer fakeouts and emotional stress.

- Strong momentum movement.

If you’re trading chart patterns like triangles, rectangles, or flags, a clean breakout is your confirmation to enter with confidence.

Best Strategy to Trade Clean Breakouts in Forex

- Identify key levels (support/resistance or pattern boundaries).

- Wait for a clean breakout candle close.

- Optional: Wait for a retest of the broken level for safer entry.

- Place stop loss below/above the breakout candle.

- Target 2:1 or higher risk-to-reward ratio.

Conclusion

A clean breakout in candlestick price action is a high-probability setup that every serious trader should master. By waiting for a strong candle close beyond key levels, you increase your chances of entering profitable trades while avoiding fakeouts. Remember, patience is key — let the market show its hand before you act.