CANDLESTICK COUNT STRATEGY

candlestick counting strategies are used in various forms across technical analysis. These strategies rely on counting the number of candles in a trend, pattern, or cycle to anticipate potential reversal or continuation points.

Here are some common ones:

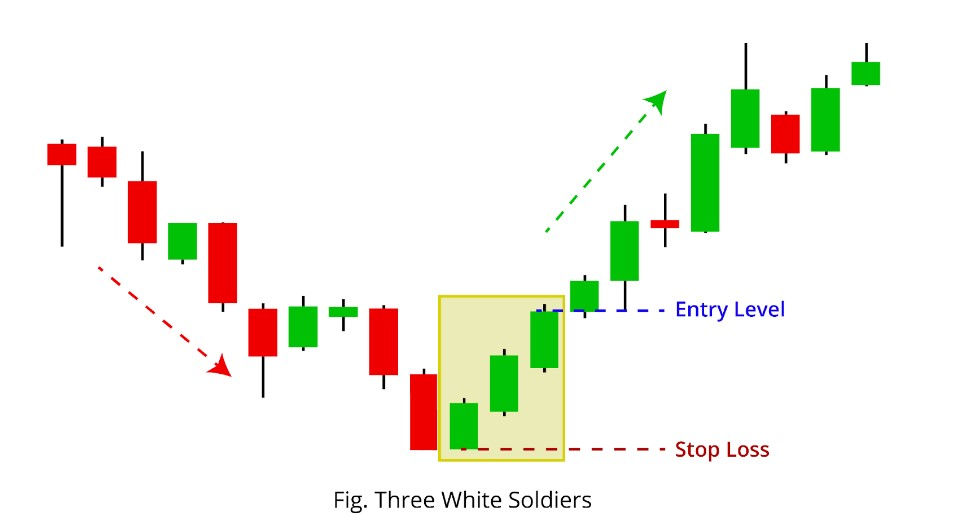

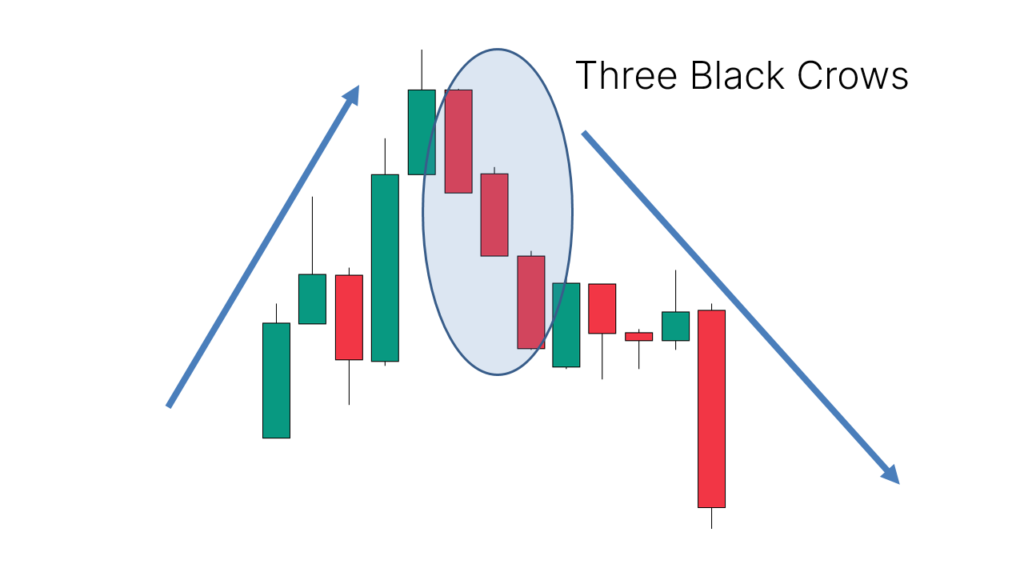

1. Three-Bar / Three-Candle Patterns

These are very basic but common patterns used to anticipate reversals.

- Three White Soldiers (Bullish): 3 strong bullish candles in a row after a downtrend ? bullish reversal.

- Three Black Crows (Bearish): 3 strong bearish candles after an uptrend ? bearish reversal.

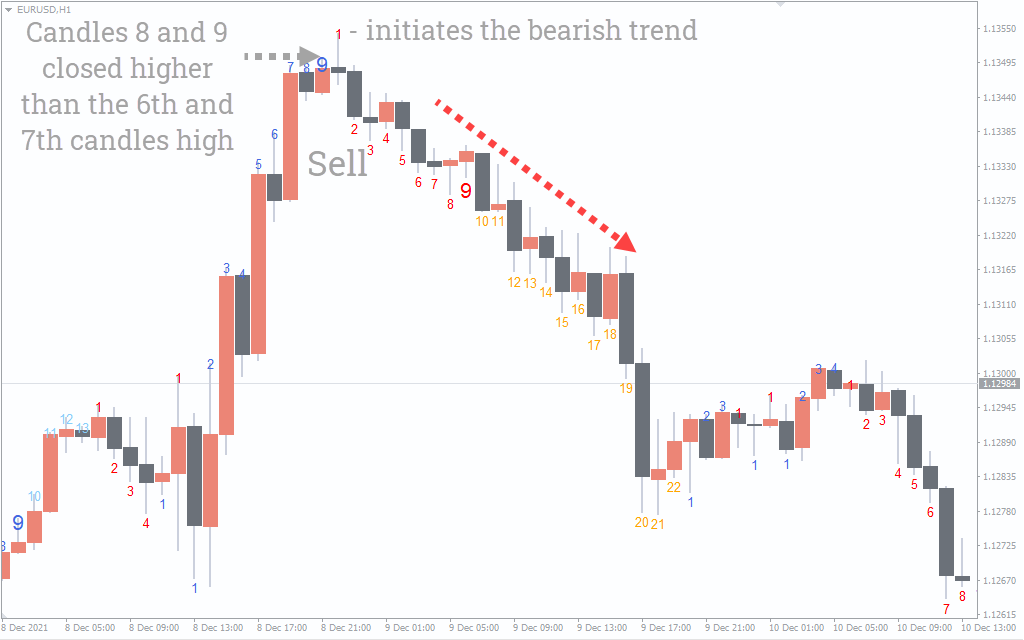

2. 9 or 13 Candle Reversal Count (TD Sequential by Tom DeMark)

A more advanced candle-counting method used to predict exhaustion in a trend.

- Setup Phase: Count 9 consecutive candles that close higher (bullish) or lower (bearish) than 4 candles earlier.

- Countdown Phase: Optional phase that counts 13 candles based on specific rules.

- Reversal Expected: After 9 or 13 counts, price may reverse or stall.

This method is used on all timeframes and is especially popular among institutional traders.

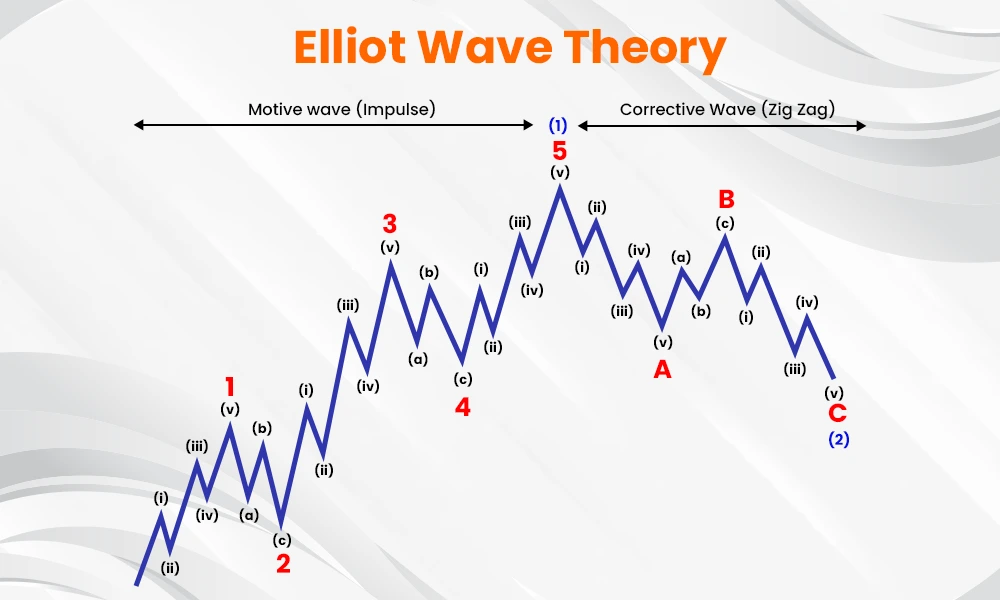

3. Cycle-Based Candle Counting

Some traders count swings or candles based on cyclical behavior:

- 5-wave or 8-candle cycles: Based on Elliott Wave or market rhythm.

- For example: “After 8 strong candles in one direction, there’s a high probability of a pullback or consolidation.”

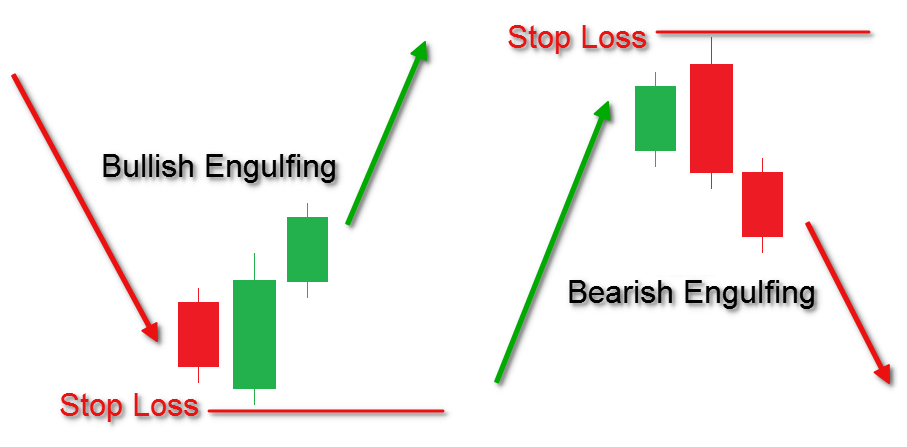

4. Engulfing Setup Count

Some traders use a system where they track:

- How many candles since last engulfing pattern?

- After every X candles, if no strong engulfing or reversal happens, trend is considered strong and continuation is likely.

- Conversely, frequent engulfing after every few candles ? signals weakness.

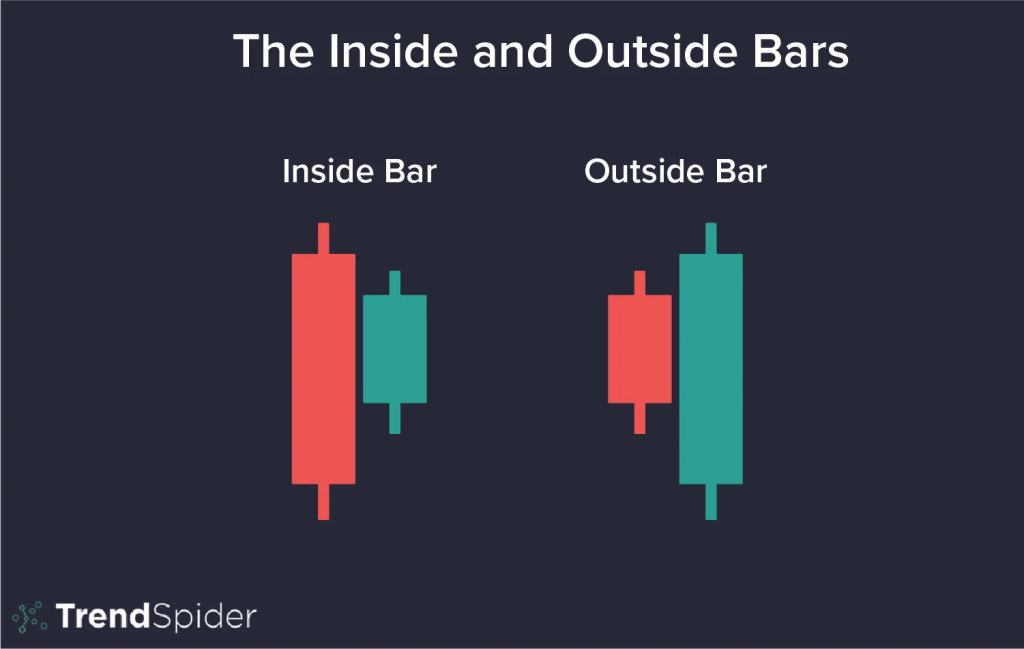

5. Inside Bar / Outside Bar Count

Strategies that count how many inside bars or outside bars appear in a trend before breakout or reversal.

- E.g., “If 3 inside bars appear in a row, look for breakout or reversal.”

- Useful for detecting compression and breakout zones.

How You Can Use It

If you’re building a strategy:

- Define a trend condition (e.g. EMA, swing high/low).

- Count candles in a trend (e.g., how many bullish candles before exhaustion?)

- Combine with confluence (support/resistance, volume, candlestick confirmation).

- Test patterns like 3-bar reversal, 9-candle exhaustion, or engulfing count.

Thanks!

ADMIN

01/06/25

PS: All photo are belong to it respective owner.