How to Spot a Fake Breakouts: 3 Clues That a Breakout Is Actually a Trap

Breakouts are exciting. Price bursts through a key support or resistance level, and traders rush in, hoping to ride the wave of momentum. But not every breakout is real. Some are fakeouts—designed to trap eager traders before sharply reversing.

If you’ve ever entered a breakout trade only to see the market suddenly snap back and hit your stop-loss, you’re not alone. In this article, we’ll explore three critical clues that can help you spot a fake breakout before it burns your account.

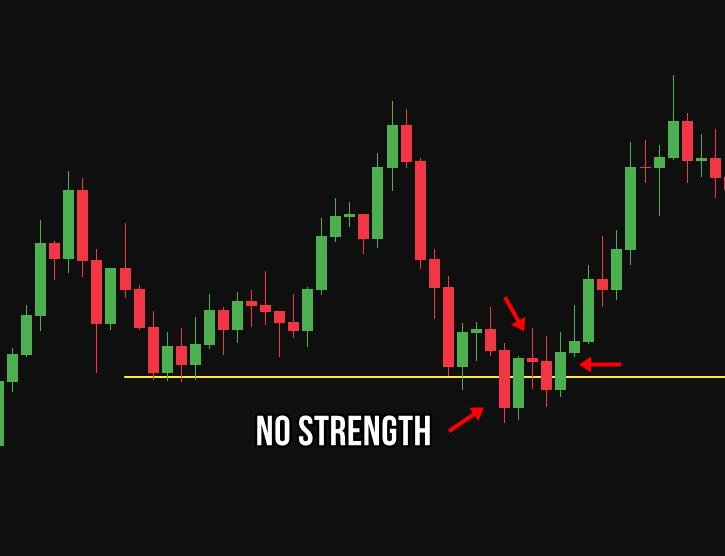

1. Price Breaks a Key Level – But Without Strength

A breakout should ideally occur with strong momentum. If the price slowly creeps past a key level—like a major support, resistance, or trendline—be cautious. A sluggish or hesitant move often signals a lack of conviction.

Look for:

- Weak candles near the breakout level (e.g., doji or small-bodied candles)

- Price hugging the line without clean separation

This kind of behavior suggests indecision, not strength. A true breakout should leave no doubt—it breaks hard and fast.

2. Sharp Reversal After Breakout

One of the most telling signs of a fake breakout is what happens immediately after the breakout.

If price breaks out, holds briefly, and then snaps back violently in the opposite direction, you’ve just witnessed a classic trap.

This usually occurs because:

- Smart money pushed the price past the level to trigger stop orders

- Then, once retail traders enter late, the price reverses to trap them

Clue:

Watch for engulfing candles or long wicks right after the breakout. These show rejection, not continuation.

3. Trap Pattern Formation: The Bull or Bear Trap

Fake breakouts often form a trap pattern:

- Bull trap: Price breaks above resistance, then quickly drops below the level.

- Bear trap: Price breaks below support, then quickly rises above it.

These traps are often used by large players to manipulate retail traders into entering at the worst possible time.

Smart Strategy:

Wait for a retest. Let price break out, then see if it holds that level when tested again. If breaks = potential trap.

Conclusion: Trade the Confirmation, Not the Excitement

A true breakout is backed by volume, momentum, and follow-through. A fake one gives itself away through hesitation, lack of confirmation, and sudden reversal.

Before jumping into any breakout trade, ask yourself:

- Is the break is clean break?

- Is there strong price action confirmation?

- Am I late to the move?

- Can I wait for a retest?

- Is there any potential trap?

By spotting these 3 key clues, you can avoid traps and only enter when the odds are truly in your favor.

ADMIN

17/06/25