Linear Risk Per Trade Approach

The linear risk per trade approach refers to a trading risk management strategy where a fixed percentage or amount of capital is risked on every trade, regardless of the size of the trading account or market conditions. It is a straightforward and consistent way to manage risk. Here’s how it works and its implications:

How Linear Risk Per Trade Works

- Fixed Risk Percentage or Amount

- Traders determine a fixed percentage of their account equity or a specific dollar amount to risk per trade.

- Common percentages range from 0.5% to 2% of total account equity per trade.

- Example: For a $10,000 account, risking 1% per trade means risking $100 on every trade.

- Consistent Position Sizing

- Position size (lot size or number of shares) is calculated based on the fixed risk amount and the distance to the stop-loss level.

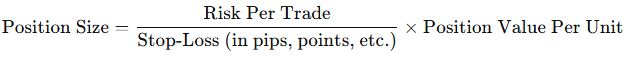

- Formula for Position Size: Position Size=Risk Per TradeStop

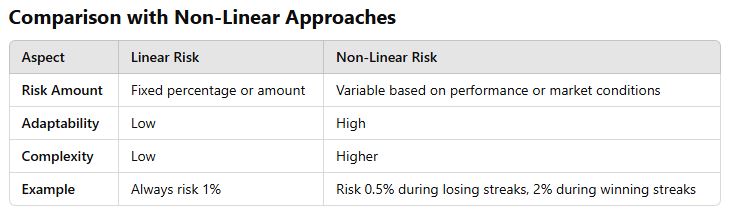

- No Scaling

- The amount risked does not change based on past trade outcomes or current market dynamics.

- It remains consistent regardless of whether the trader is on a winning or losing streak.

Benefits of the Linear Risk Per Trade Approach

- Simplicity

- Easy to calculate and implement, especially for beginners.

- Capital Preservation

- Limits the impact of losing streaks, ensuring that no single trade or series of trades can decimate the account.

- Consistency

- Promotes discipline by avoiding emotional decision-making around risk.

Drawbacks of the Linear Risk Per Trade Approach

- Does Not Adapt to Performance

- If a trader is on a winning streak, it doesn’t leverage increased equity as effectively as a progressive risk model might.

- Similarly, during losing streaks, it does not reduce risk to protect capital further.

- Ignores Market Conditions

- The fixed risk doesn’t account for varying market volatility or setups with higher or lower probabilities.

Who Should Use Linear Risk?

- Beginner Traders: Provides a solid foundation for learning risk management without overcomplicating calculations.

- Risk-Averse Traders: Ideal for those prioritizing capital preservation over aggressive growth.

Final Thought

The linear risk per trade approach emphasizes consistency and discipline, two critical traits for successful trading. While it may not maximize returns during favorable periods, its simplicity and focus on preservation make it a reliable choice for long-term trading success.