Multi-Timeframe Made Easy – Even newbie can profit from it easily! | Basic Strategy

When traders jump into a trade too quickly, they often miss the bigger picture—leading to unnecessary losses and emotional decisions.

Note: This article is best view using laptop or PC.

Multi-timeframe analysis (MTFA) is a powerful solution. It helps you align your trades with the dominant trend, spot high-quality setups, and time your entries with precision.

In this article, we’ll simplify the process using a 3-step breakdown across three timeframes:

Visual Breakdown:

This simple flow keeps you focused, structured, and calm.

1. D1 (Daily): Find the Market Direction

The daily timeframe acts as your compass. It helps you identify the overall trend or bias—whether the market is bullish, bearish, or ranging.

Ask yourself:

- Is the market making higher highs and higher lows?

- Are we near key support/resistance levels?

- Is price inside a trending channel or bouncing within a range?

By analyzing D1 first, you avoid trading against the tide. It sets the tone for the rest of your analysis.

Pro Tip:

Mark major zones on D1 and use them as boundaries for your lower-timeframe trading.

2. H1 (1-Hour): Wait for the Setup to Form

Once you’ve identified the trend, drop to H1 to look for your setup—a recognizable chart pattern, signal, or condition that aligns with your D1 bias.

Popular setups include:

- Break and retest of structure

- EMA crossovers

- Rejection candles at key zones

- Trend continuation flags or triangles

Goal:

H1 gives you the structure. Is there a consolidation, pullback, or breakout opportunity setting up?

You don’t enter yet. You just prepare.

3. M15 (15-Minute): Precision Entry

The final step: drop to M15 to execute with accuracy. This timeframe is where you look for fine-tuned price action to confirm your entry.

On M15, you can:

- Spot rejection wicks or engulfing candles

- Identify micro-structure shifts

- Use tight stop-loss levels with proper risk management

Advantage:

Entries on M15 allow better reward-to-risk ratios because your stop-loss can be tighter while still respecting higher-timeframe structure.

Why This Process Works

Most losing traders trade based on one timeframe—usually the one they’re most emotionally attached to.

But markets are multi-layered. MTFA allows you to:

- Trade with the dominant trend, not against it

- Spot clean, high-probability setups

- Enter with confidence and clarity

It’s not about complexity. It’s about discipline and structure.

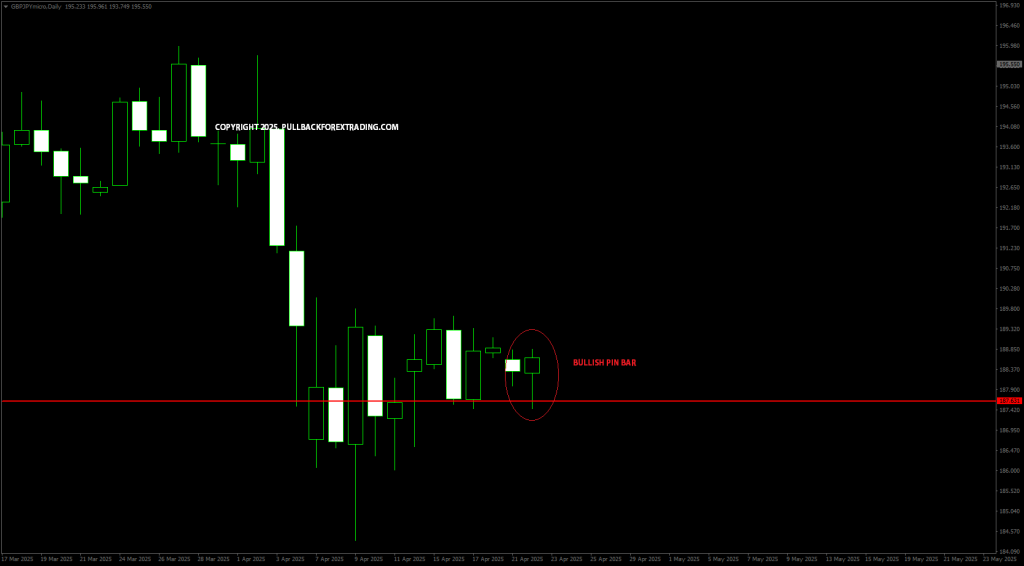

EXAMPLE:

Lihat lagi satu contoh:

Final Thoughts

If you’ve ever felt lost in the charts or suffered from late entries and false breakouts, it’s probably because you lacked a clear framework.

With D1 > H1 > M15, you:

- Understand the direction

- Find a reliable setup

- Time your entry with precision

Keep it simple, trust the process, and always let the higher timeframe lead.

Another entry tips to consider:

- Fibo retracement M15

- TL breakout for entry at M15

- EW, Waves 2 at M15

- TL Waves to confirmed wave 2 setup at M15

- Significant SNR at H1/M15

Scale-In strategy based on structure also can be considered to max the profit potential.

Thanks!

ADMIN

17/07/25