Why Online Trading with Forex Brokers is So Popular and Why You Should Consider It as Your Part-Time Income

What is Online Trading and Why You Should Know?

Online trading has surged in popularity, with many individuals seeking ways to diversify their income streams. Trading platforms, particularly forex brokers, offer access to various financial markets, including forex (foreign exchange), CFDs (contracts for difference), and ETFs (exchange-traded funds). Here are some reasons why these forms of trading have gained traction and why you might consider them for part-time income, especially with the benefits provided by forex brokers.

Accessibility and Convenience

One of the primary reasons for the popularity of online trading is its accessibility. With an internet connection and a computer or smartphone, you can start trading from anywhere in the world. Forex brokers provide user-friendly platforms that are designed to cater to both beginners and experienced traders. Many brokers also offer mobile apps, making it even more convenient to trade on the go.

Easy Deposit and Withdrawal

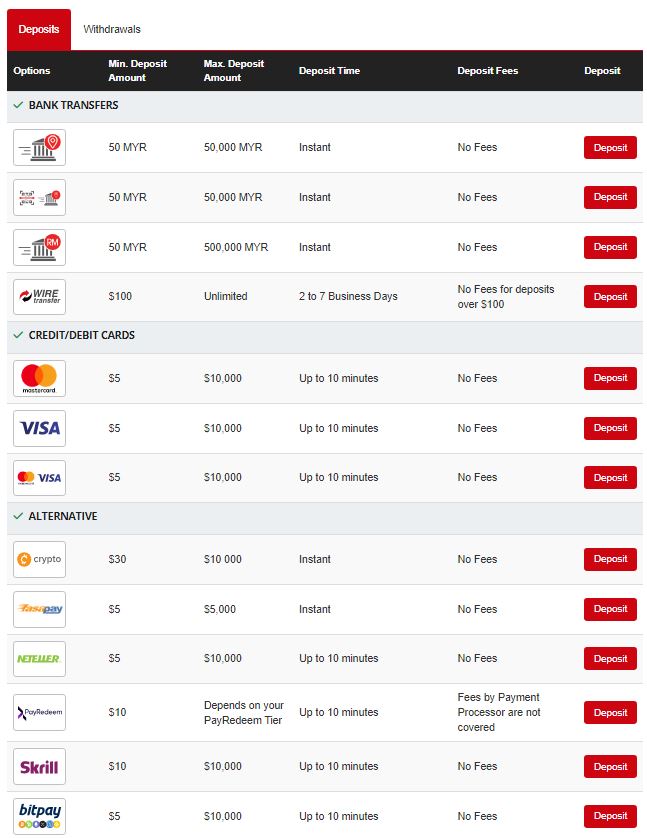

Forex brokers have made the process of depositing and withdrawing funds incredibly straightforward. They support various payment methods, including bank transfers, credit/debit cards, and e-wallets like PayPal and Skrill. This ease of transaction ensures that you can quickly fund your trading account or withdraw your profits with minimal hassle. The efficiency of these processes adds to the appeal of online trading, as traders can manage their funds with confidence and convenience.

Low Entry Barriers

Online trading platforms often have low minimum deposit requirements, making it easier for new traders to enter the market. Forex brokers frequently offer micro accounts that allow you to start trading with a small amount of capital. Additionally, many brokers provide demo accounts where you can practice trading with virtual money, allowing you to develop your skills and strategies without any financial risk.

Variety of Markets

Forex trading, along with CFDs and ETFs, offers a wide range of trading opportunities. Forex trading involves the buying and selling of currency pairs, providing high liquidity and the potential for substantial returns due to leverage. CFDs allow you to speculate on the price movements of various assets, including stocks, commodities, and indices, without owning the underlying asset. ETFs are investment funds that hold a diversified portfolio of assets, providing a lower-risk option for those looking to invest in a broader market segment.

Flexibility

Online trading can be tailored to fit your schedule, making it an ideal option for part-time income. The forex market operates 24 hours a day, five days a week, allowing you to trade at any time that suits you. This flexibility means you can trade around your primary job or other commitments, making it easier to integrate trading into your daily routine.

Potential for Profit

While trading carries risks, it also offers the potential for significant profits. By learning market analysis techniques and developing a disciplined trading strategy, you can capitalize on market movements. Many successful traders started part-time and gradually increased their trading activity as they gained experience and confidence. Forex brokers often provide educational resources and analytical tools to help you make informed trading decisions.

Continuous Learning and Skill Development

Trading requires ongoing education and skill development, which can be intellectually stimulating and rewarding. Many traders find the process of analyzing markets and developing strategies to be highly engaging. Numerous online resources, including courses, webinars, and forums, are available to help you improve your trading skills and stay updated on market trends. Forex brokers often host webinars and provide educational materials to support your learning journey.

Community and Support

The online trading community is vast and supportive, with forums, social media groups, and mentorship programs available to help traders connect and share knowledge. Engaging with this community can provide valuable insights, support, and motivation as you navigate the world of trading. Many forex brokers offer customer support and community features to ensure you have the assistance you need.

Conclusion

Online trading with forex brokers offers numerous advantages that make it an attractive option for part-time income. The accessibility, ease of deposit and withdrawal, low entry barriers, variety of markets, flexibility, potential for profit, continuous learning opportunities, and supportive community all contribute to its growing popularity. If you’re looking for a way to supplement your income and are willing to invest the time to learn and develop your trading skills, online trading with a reliable forex broker could be a worthwhile endeavor.

Choosing the right broker; Why HF Markets is the Right Broker for Your Trading Needs

Choosing the right broker is crucial for a successful and secure trading experience. HF Markets (SV) Ltd, known for its robust regulatory framework and diverse offerings, stands out as an excellent choice for traders.

Here’s why HF Markets should be your broker of choice:

Regulatory Compliance

HF Markets operates under stringent regulatory standards, ensuring a secure trading environment. The broker is authorized and regulated by multiple respected financial authorities globally:

- FCA (Financial Conduct Authority, United Kingdom): HF Markets (UK) Ltd is authorized and regulated by the FCA under firm reference number 801701. The FCA is known for its rigorous regulatory standards, promoting fair and transparent financial markets.

- DFSA (Dubai Financial Services Authority): HF Markets (DIFC) Ltd is regulated by the DFSA under licence number F004885. DFSA oversees financial services in the Middle East’s leading financial hub, ensuring world-class regulatory compliance.

- FSCA (Financial Sector Conduct Authority, South Africa): HF Markets SA (PTY) Ltd is authorized by the FSCA under licence number 46632. The FSCA regulates South Africa’s non-banking financial services industry, including the Johannesburg Stock Exchange (JSE).

- FSA (Financial Services Authority, Seychelles): HF Markets (Seychelles) Ltd is regulated by the FSA under Securities Dealer Licence number SD015. The FSA oversees non-bank financial services in Seychelles.

- CMA (Capital Markets Authority, Kenya): HFM Investments Ltd is authorized by the CMA in Kenya as a non-dealing online forex broker with licence no. 155. The CMA supervises and licenses market intermediaries in Kenya.

Additionally, HF Markets (SV) Ltd is registered in St. Vincent & the Grenadines as an International Business Company with the registration number 22747 IBC 2015, under the International Business Companies (Amendment and Consolidation) Act, Chapter 149.

Easy Deposit and Withdrawal

HF Markets offers a seamless deposit and withdrawal process, supporting various payment methods including bank transfers, credit/debit cards, and e-wallets like PayPal and Skrill. The broker ensures fast processing times, allowing you to manage your funds efficiently and with minimal hassle. Transparency in fee structures further enhances the ease of transactions, making financial management straightforward.

Types of Accounts

HF Markets provides a variety of account types to cater to different trading needs and experience levels:

- Cent Account: Designed for beginners or those trading smaller volumes, featuring lower minimum deposit requirements and smaller contract sizes.

- Zero Spread Account: Suitable for traders looking for precise cost control, this account type offers fixed spreads of 0 pips with a small commission per trade.

- Pro Account: Tailored for experienced traders, offering tighter spreads, higher leverage, and access to a wider range of trading instruments.

- Premium Account: Ideal for serious traders and investors, this account type offers premium features such as lower spreads and enhanced trading conditions.

- Top-Up Bonus Account: Provides a 20% bonus on deposits, up to $5,000, allowing traders to enhance their trading capital and take advantage of additional market opportunities.

More info about account above(i.e. spread, minimum deposit/withdrawal or others) please visit here.

Comprehensive Trading Services

HF Markets offers a wide array of trading services and instruments, including currencies, commodities, indices, CFDs, and leveraged financial instruments. This variety ensures that traders can diversify their portfolios and access numerous market opportunities.

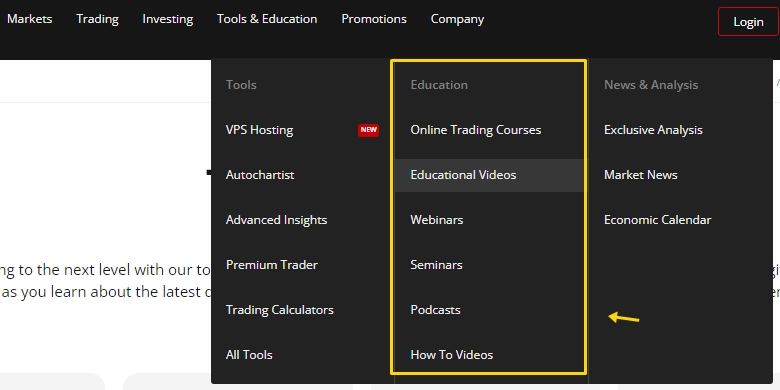

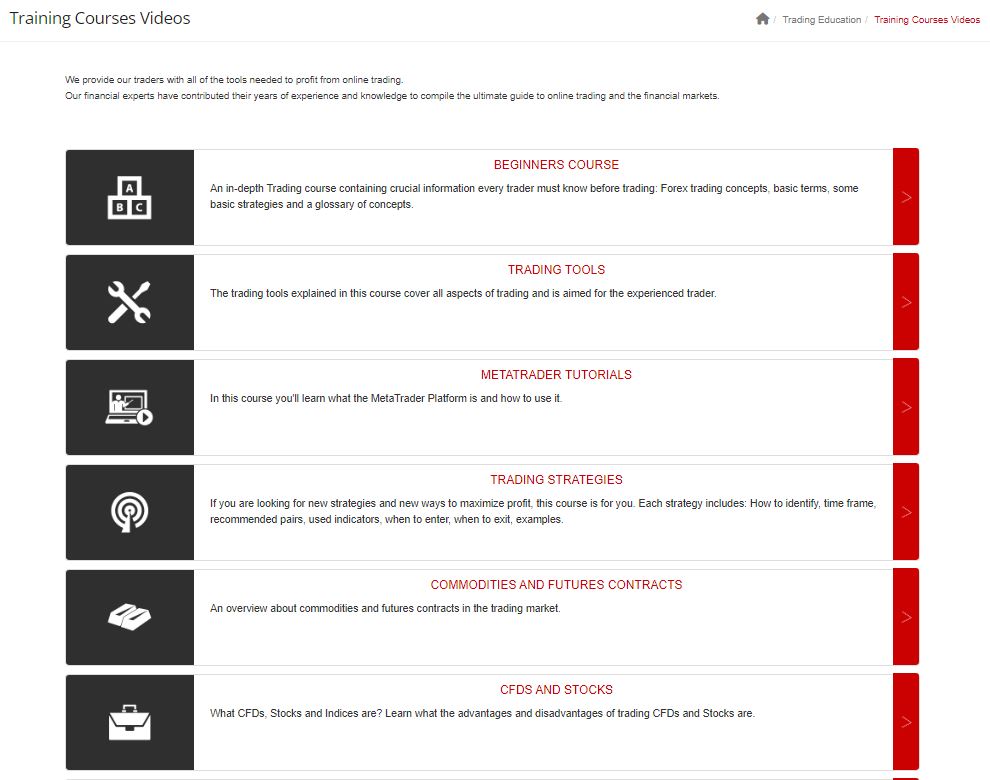

Education

HF Markets offers online education as well as webinar for traders. Click photo below for more info.

Robust Trading Platform

The broker provides access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their advanced trading tools and user-friendly interfaces. These platforms are available on desktop and mobile, ensuring you can trade effectively from anywhere.

Exceptional Customer Support and Educational Resources

HF Markets excels in customer support, offering 24/5 assistance through various channels including live chat, email, and phone. Additionally, the broker provides extensive educational resources such as webinars, tutorials, and market analysis, helping traders enhance their skills and knowledge.

HFM Awards

HF Markets is award winning forex broker with more than 70 awards! Click here for list of awards.

Conclusion

HF Markets stands out as a reliable and versatile broker, offering robust regulatory compliance, easy deposit and withdrawal processes, diverse account types, and comprehensive trading services. Whether you are a beginner or an experienced trader, HF Markets provides the tools, security, and support necessary for a successful trading experience. Choosing HF Markets means opting for a broker committed to providing a trustworthy and efficient trading environment.

Click here to register today!

#hfmarkets #hotforex #hfm